Through education, awareness and resources, Human Resources is committed to fostering a healthy workplace for all VIU employees. The goal of our employee health and wellbeing programs is to create a community that fosters individual health and wellness at work and beyond.

Manulife Services: VIU's Benefits Provider

Your Manulife ID is your key to all things Manulife. It’s a single, secure username and password for accessing all Manulife products and services.

Did you know that the best and fastest way to manage your benefits is online? Here are some helpful links to get you started:

- Step-by-step instructions on How to Set Up Your Manulife ID

- Learn how to submit your claims online and get them processed quickly.

- Download the Manulife Mobile app and manage your benefits account right from your smart device.

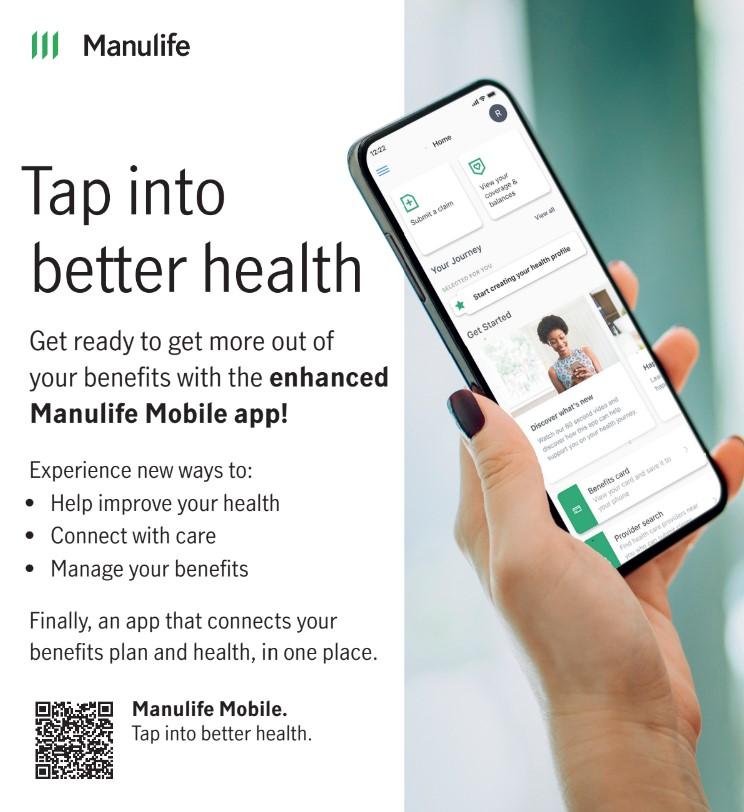

Manulife Mobile App - Tap Into Better Health

VIU’s employee benefits plan has an enhanced Manulife Mobile app … and you can now start earning Aeroplan points! Manulife will email employees with benefits with more information on how to sign up and earn points.

If you are covered under our extended health and dental plan, you will be able to earn points for health and benefits-related activities, all while managing your overall wellbeing. By engaging in challenges (either team or individual based), you will have the opportunity to earn points for:

- completing healthy initiatives, like exercise, mindfulness practices and more

- complete educational courses and helpful benefits tips and tricks, like downloading your digital benefit card.

Contact Benefits@viu.ca instead of Manulife for the following benefits changes:

- Coordination of benefits (if you are covered under more than one plan)

- Adding/removing/updating dependents

- Overage dependent changes (dependents turning 21 or 25)

For any other inquiries, call the Manulife Benefits HelpLine at 1.800.575.2200. Be sure to have your Plan Contract Number (83719) and your Certificate Number available (this information is available on your benefits card).

Electronic Benefits Booklet

Please click on the link for your jurisdiction below for details on your Extended Health and Dental coverage. Benefits booklets have extensive details of VIU's benefits plans, but if you would like a quick reference of benefits offerings, have a look at our Benefits Blueprints for each jurisdiction.

Claim Submission

Log in to your Plan Member Secure Site to submit claims online. You can also download the Manulife Mobile app to your smartphone for quick and convenient claim submission. This app also provides a digital copy of your benefits card which can be used to show your treatment provider/pharmacist.

Claims must be submitted to Manulife within 12 months following the date the service was performed (e.g. if you received new eyeglasses on January 2, and if you are still employed by VIU, you will have up to 12 months after that date to submit your claim).

If your coverage terminates due to resignation, retirement, etc., your claim must be submitted to Manulife within 90 days of termination of benefits.

Many treatment providers have direct billing set up with Manulife for claims submissions, and this can be done at the time the service is being provided. All you need to do is provide your benefits card and they will submit the claim directly to Manulife. If your provider does not have direct billing set up with Manulife, please keep your receipts and submit through your profile on the plan member site for reimbursement. Health Care Providers can submit your claims to Manulife right from their office.

Out-of-Province and Out-of-Country Coverage

If you need to make a claim for a medical issue while you were outside of BC or Canada, please submit your claim first to MSP and then to Manulife:

- MSP Out-of-Country Claim form see Leaving BC Temporarily Information Sheet

- Manulife Out of Province / Out of Canada Claim form

Manulife provides Out-of-Province/Out-of-Canada travel assistance for employees and their dependents who have extended health and dental coverage through VIU. This is outlined in further detail in your jurisdictions benefit brochure (available in the links above or when you log into your Manulife account). The travel assistance numbers are located on the back of your benefits card should you need assistance while travelling, or you can open a case through the Manulife portal. For more information, please look through your benefits brochure.

Manulife’s travel insurance benefits will cover medically stable conditions when travelling. This means, you must be deemed medically stable 90 days prior to departure. The Emergency Travel Assistance brochure supplies more information about the definition of medically stable and what’s covered when you are travelling. If you have further questions, please contact the Manulife Benefits HelpLine at 1.800.575.2200. You also want to check if there is a travel advisory for the area you are traveling to. If you are traveling somewhere questionable, it might be best to call Manulife prior to departure.

For more information, see COVID-19 and your travel insurance and Manulife’s COVID-19 Pandemic Travel Plan.

Benefit Premiums While On Leave

If you are taking a leave and have received a memo from HR in which you have the option of keeping your extended health and dental plan active for the duration of your leave, you may need to pay the monthly premiums for these benefits. Please let the Benefits Coordinator know as soon as you are able about your decision of keeping your extended health and dental benefits active or dropping these benefits during your leave (and have no coverage). Here is the current Premiums While on Leave effective April 1, 2025 cost breakdown per jurisdiction/per coverage for this year; do note these rates change every April 1.

Teladoc Health

Teladoc Health is a healthcare consulting service available to VIU employees with extended health benefits and their covered family members. Whether you are seeking an expert second opinion on a medical diagnosis, questioning surgery, need help finding the right specialist or want advice about a health issue, Teladoc Medical Experts will provide you with the answers you need to confidently move forward with your care. Call 1.877.419.2378 or submit your request online.

Contact Us

For more information about group benefits including enrolments, changes, terminations, medical leaves, and general inquiries, please contact: Benefits@viu.ca.