Please use a fresh, up-to-date form for each new submission for your Payment Requisition or Expense Claim from Finance Forms or your claim may be rejected. Please do not copy and paste data or the form's formulae may not work. These forms were created to integrate with the FIS and they will not work as intended if they are out of date or missing formulae. This may delay your payment!

For extra assistance contact accounts.payble@viu.ca or a Tech Champion in your area.

See Glossary for definitions of new terms.

See menu under "Employee training" for all categories of training materials. We continuously update as we progress through system implementation and updates.

For Employee expenses and travel please go to Employee expenses and travel.

See bottom of Procurement for training session recordings as well as helpful Q&A session videos.

See Self-assessments for onboarding tools to help your team with Employee Portal training including AP quizzes.

Use the FRS to FIS coding generator tool to find your Work Order. Act/Intake, Account and Product Codes!

Accounts Payable

The Purchasing card is a US Bank Canada Visa card. The purpose of the Purchasing card is to facilitate small dollar purchases of legitimate expenses incurred on behalf of university business units. Charges on the consolidated Purchasing card statement will be expensed to the cardholders’ Work Order.

Learn more about the Purchasing card.

Purchasing card explains the steps you take to reconcile your monthly PCard account activity statements and submit them for approval. Any questions should be directed to PCards@viu.ca.

Finance will be updating the cardholder default accounting code to include:

- Account (previously object code)

- Work Order (previously cost centre)

- Activity/Intake Code (new field)

Therefore, when reconciling your Purchasing card statement you see this information in the Accounting Code field. Users who charge items to other Work Orders or accounts will still be able to change the default accounting code.

Note

- Keep the leading zeros in the fields

- Only the first 4 digits (ex. 6500-1) are required for the account code. You can ignore the -1, -2, -3, etc. as they reflect the taxes. (Any tax adjustments will be made by the Accounts Payable team)

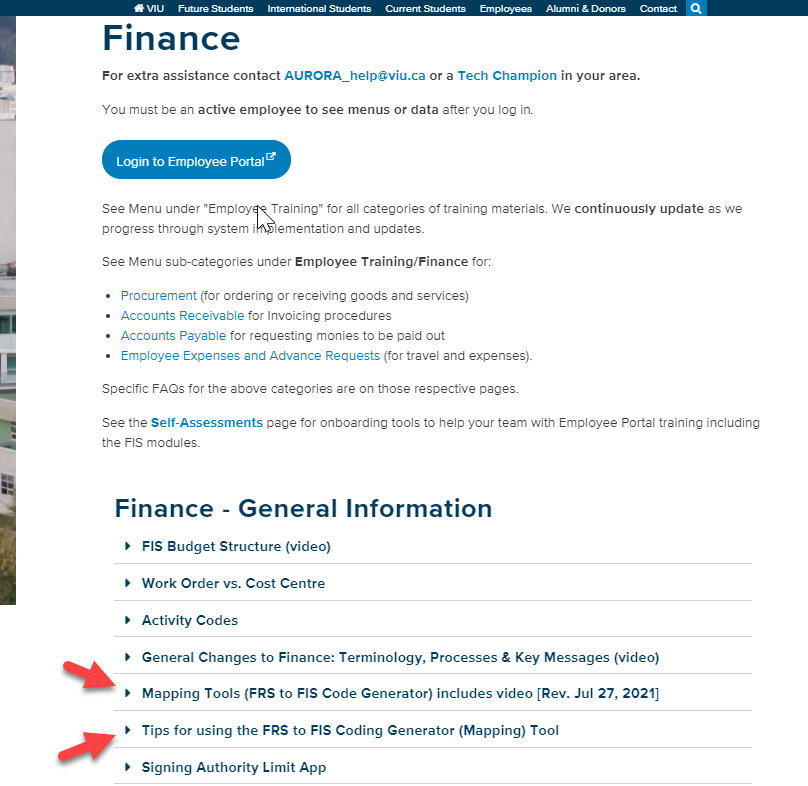

To find and use the mapping tool created to help you map or translate from the old FRS codes to the new FIS codes go to Finance training and to these mapping Tools sections:

The process of obtaining a card, reconciling and submitting your monthly statement will remain unchanged. The Purchasing card procedure is available at Purchasing card.

VIU has a stationery contract with Staples Business Advantage. The process allows authorized individuals to order stationery products online and ensures the VIU community is taking advantage of the negotiated discount prices.

Orders are placed on the Staples Business Advantage Eway website and delivered to your location. Charges on the consolidated Staples Business Advantage invoice will be charged to the Work Order linked to your account.

Finance will be updating your existing cost centres to Work Orders. If you have multiple cost centres in your Staples Business Advantage Eway account, these will be updated to reflect the new Work Order numbers.

The process of setting up your online account, placing your orders and processing of the monthly consolidated invoice will remain unchanged. See the employee website for the Staples Business Advantage procedure.

Cellular services at VIU are provided on a negotiated contract by Rogers Wireless. Cell phones and services are ordered through the Procurement department. Charges on the consolidated Rogers billing statement will be expensed to the cell phone holders' Work Order.

No changes. Finance will be updating your existing cost centres to Work Orders.

The process of obtaining a phone and your monthly expenses charged will remain unchanged.

See the Rogers cell phone procedure.

There are times when a cheque issued by VIU is required to be cancelled. Some examples include:

- The cheque has been lost or destroyed

- The cheque has become stale dated and can no longer be negotiated

- The cheque was requested in error or to the incorrect payee name

- The event the cheque was issued for was cancelled

To request a cancellation of the cheque, follow this process:

- Send an email to accounts.payable@viu.ca to request the cancellation. Include the following information:

- Cheque number if known

- Cheque date

- Payee name

- Cheque amount

- Reason for cheque cancellation request

- Advise if a replacement cheque is required, and provide updated payment details

- Please allow two weeks for cancellation and reissuance of a cheque

- Note that VIU is required to pay a banking fee for stop payment and cheque cancellations, and these costs will be deducted from the replacement cheque as required.

- If you have the original cheque, mark it “Void” and return the original item to Accounts Payable. Banking fees for stop payments will apply.

- Payments made by EFT or Wire transfer cannot be recalled once the transfer of funds has been made. If a payment made by these pay methods was requested in error, you are responsible for arranging the return of funds.

Approval from proper $ signing authority

VIU has a new audit requirement for “one level up” signing authority. For example, a requisitioner cannot authorize a request that they have created; the authorization must be from an individual with higher signing authority on the Work Order.

As workflow will not be configured to include approvals based on signing authority $ limits for go-live, the requisitioner must request approval by email from the proper individual who has authority for the total $ amount. The approver must send the approval email directly to Procurement at procurementservices@viu.ca and copy the requisitioner. The requisitioner must attach the approval email to the requisition as a document, preferably in PDF format. The email subject line should read “Requisition approval.”

If a requisitioner has signing authority for a specific $ amount and the

requisition total is within their signing limit, the requisitioner must request approval from someone within their department with a higher signing limit (i.e. one level up). Again, the approver must send the approval email directly to Procurement at procurementservices@viu.ca. The email subject line should read “Requisition approval.” Please note this is a new audit requirement that is required moving forward.

Learn more: Access the VIU Apps > Signing Authority application to see the Spending Authority item.

No. Your PCard has a spending limit that has already been approved by your supervisor, so you are able to use it without obtaining pre-approval. However, when it comes time to reconcile your “PCard account activity statement” at the end of the month, you will require “One level up” approval on your statement, even if the total $ amount of your statement is within your signing authority.

Goods or services that are allowed to be procured with a PCard do not require a Purchase Requisition.

Yes, tax self-assessments will continue to be processed by AP. You will see the self-assessment at the time the invoice is processed.

Initially, Telus and Ricoh charges will not be distributed to departmental Work Orders. Telus invoices will be charged directly to IT and Ricoh invoices will be charged directly to the Printshop. Methodology for these charges remains unchanged, however, development of the allocation process was put on hold during the Finance go-live. Once the process is developed, charges will resume and it’s quite likely that retroactive charges will be applied. Budget variances will occur in the short term.

For more information around these charges, please read the AURORA FIS Bulletin: Central charge allocations.

There are several considerations when processing a student payment. In some cases, the payments are deemed a taxable benefit to the student and a T4A will be issued to the student per CRA regulations. Below you will find the appropriate treatment for various student payment requests.

Reimbursement of purchases on behalf of VIU

Scenario

A student has purchased supplies or services on behalf of VIU at the direction of a VIU employee (VIU will retain ownership of the supplies) and reimbursement is required.

Process:

Download the Payment Requisition form. Complete the form, attach PDF images of all detailed receipts, receive formal approval and submit all to Accounts Payable at accounts.payable@viu.ca.

Scholarships and bursaries (collectively awards)

Scenario

A student is eligible to receive a tuition credit, living allowance or a payment of an award by cheque.

Process:

Request a “Gift Disbursement Form” from foundation@viu.ca. Complete the form and submit to accounting services at generalaccounting@viu.ca.

Note: These payments are deemed to be a taxable benefit to the student and a T4A will be issued to the student per CRA regulations.

Ad hoc reimbursements to students that are not scholarships and bursaries (awards)

Scenario

A student is reimbursed for items where the reimbursement is a direct benefit to the student. Examples include payments for student textbooks, supplies, travel, etc.

Process

Download the Work Order Payment for Scholarships and Bursaries form. Complete the form, obtain formal approval and submit to Accounts Receivable at acctsrec@viu.ca. No receipts are required to be submitted to Accounts Receivable.

Note: These payments are deemed to be a taxable benefit to the student and a T4A will be issued to the student per CRA regulations.

Remuneration for fee for service

Scenario

A student provides a service to VIU and you want to compensate them for this service. Examples include musicians, tour guides, etc. These are one-time small dollar payments (less than $500.00) and are considered a fee for service (GL account 6005).

Process

Download the Payment Requisition form. Complete the form, receive formal approval and submit all to Accounts Payable at Accounts.Payable@viu.ca.

Questions? If you have any questions about which form and process to use, please contact GeneralAccounting@viu.ca.

Supplier invoices: the business unit's responsibility

Supplier invoices are broken down into two different categories:

- The PO invoice: These are invoices for goods and services procured on behalf of VIU via a VIU Purchase Order (PO). The PO issued to the supplier will outline the terms and conditions of the purchase, and direct the Supplier to make all invoices out to Vancouver Island University and forward the invoices directly to Accounts Payable via email.

- The Non-PO invoice: These are invoices processed without a PO (i.e. a PO is not required). These invoices are limited to transactions that are generated based on a third party interaction with VIU (i.e. brokerage fees, freight charges, credit card payments etc.). As the process is specific, there will be very few Non-PO invoices.

- PO invoice: The PO invoice will be received by Accounts Payable and registered against the PO. The registration process will match the invoice amount to the PO and direct the invoice to the Purchase Requisitioner in the form of a Goods Receipt workflow task for completion. Once the Purchase Requisitioner completes the Goods Receipt, the task will continue through the remaining steps in workflow for posting.

- Non-PO invoice: The Non-PO invoice must be authorized and the posting string (i.e. Work Order, Account and Activity/Intake code) provided before the invoice can be processed in Accounts Payable. Non-PO invoices will be scanned and sent via email to the appropriate signatory within the business unit to request the Work Order, Account, Activity code information, and authorization for payment.

- PO invoice: If you have received a paper copy of a PO invoice, the original invoice will need to be sent via internal mail to Accounts Payable so they can initiate the invoice registration process.

If you have received a packing slip for items that you have received on your PO, keep the packing slip on hand for attachment to the Goods Receipt as outlined in the “PROC 12 – Goods Receipt” process. - Non PO Invoice: If you have received a paper copy of a Non-PO Invoice, the original Invoice will need to be sent to via internal mail to Accounts Payable so they can initiate the invoice registration process. Remember to have the Invoice authorized by the correct signatory and provide the posting string for processing.

Please be sure to remind the supplier that all Invoices should be sent directly to accounts.payable@viu.ca.

If Accounts Payable was not included in the email from the supplier, please forward the supplier’s email along with the invoice attachment directly to accounts.payable@viu.ca.

Please direct all questions regarding supplier invoices to Accounts Payable at accounts.payable@viu.ca.

Please do not make any payment arrangements with any supplier.

Finance monitors the Supplier relationship in terms of invoicing and payments. Payment terms are determined by the terms set in the Purchase Order, information provided in the Supplier set up form, and any other contractual items negotiated by Procurement. There may be other items you are not aware of such as credits on the Supplier account, incorrect banking information etc. that need to be considered.

For Payment Requisitions, please allow a minimum of two weeks for processing once the complete and authorized form has been received.

If you receive a payment enquiry, please direct your supplier to accounts.payable@viu.ca

While it’s important that we build strong relationships with our suppliers and ensure they are paid on time, only Accounts Payable should have access to payment information, and this is how FIS has been configured. If you are contacted by a supplier indicating they have not received payment, please forward that request to Accounts Payable.

Finance monitors the supplier relationship in terms of invoicing and payments. Payment terms are determined by the terms set in the Purchase Order, information provided in the supplier set up form, and any other contractual items negotiated by Procurement. There may be other items you are not aware of such as credits on the supplier account, incorrect banking information etc. that need to be considered.

For Payment Requisitions, please allow a minimum of two weeks for processing once the complete and authorized form has been received.

If you receive a payment enquiry, please direct your supplier to accounts.payable@viu.ca

VIU can pay suppliers (Purchase Order and Payment Requisition) by cheque, EFT/direct deposit or wire transfer.

No, you will be able to see when your PO invoice has been posted, but you will not be able to see when the supplier has been paid. Accounts Payable can provide you this information if required; however; all questions from the supplier regarding invoices and payments should be directed to Accounts Payable.

All invoices should be directed to Accounts Payable. If you have invoices arriving directly to you rather than being sent to Accounts Payable, please forward the invoice to Accounts Payable for processing. Invoices will no longer be distributed to departments to sign off as proof of receipt of goods or services. Instead, users will receive the goods and services in the system when they know the goods have been shipped or the services performed. See “PROC 12: How do I generate a Goods Receipt” for more information.

The ability to delete documents has been restricted for audit reasons.

a) If you have attached a document in error and you have not yet saved your transaction, you will need to clear your transaction and start over.

b) If you have already saved your transaction, you will need to inform either Accounts Receivable (Sales Orders) or Procurement (Purchase Requisitions & Goods Receipts) that an incorrect document was attached. Accounts Receivable or Procurement will then reject the task back to you in workflow, at which point you will have the option to either:

- Close the Purchase Requisition or Sales Order and start over, or

- Rename the incorrect document as “Document to be deleted” and then attach the correct document, if applicable. Accounts Receivable or Procurement will submit a request to remove the document to be deleted, if applicable.

Payment Requisitions

Employees will complete a Payment Requisition form in Excel format.

The following documentation (including videos) contains information regarding allowable transactions, completing the Payment Requisition form, obtaining authorization and submitting the form to Accounts Payable for payment: AP1. Payment Requisition

* These instructions were updated Mar 2, 2022 to allow for cosmetic changes as well as revised instructions for wire transfers and details in the Cheque Distribution field.

Finance Forms contains the current Payment Requisition Form.

For approvals, be sure not to attach a Portfolio PDF - only single PDFs (not batches of different emails rolled into one Portfolio PDF) can be understood by the system when uploaded.

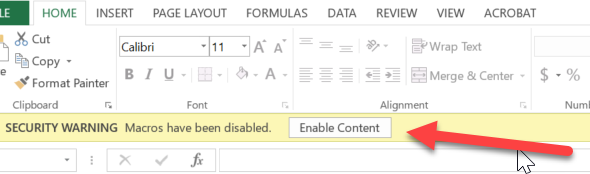

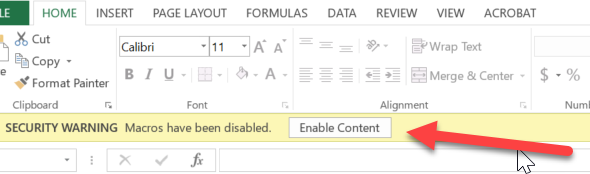

After opening the downloaded form, click the "Enable content" button to allow full functionality:

The following videos show how to complete a Payment Requisition form.

Payment Requisition form 1 (of 2) - video

Payment Requisition form video 1 of 2 - transcript.txt

Payment Requisition form 2 (of 2) - video

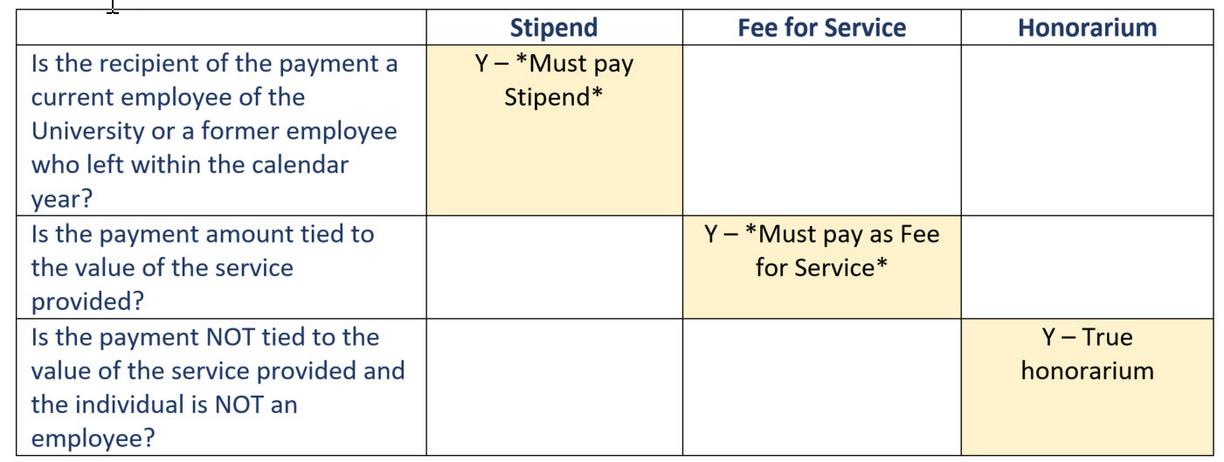

The VIU Finance department reviewed the process surrounding the payment of honorariums. A decision chart is below to ensure that the institution follows best practice and adheres to the Canada Revenue Agency regulations.

Honorariums are a payment type that is commonly misunderstood. Many times Fee for Service and Stipend payments are mistakenly requested as Honorariums. The chart below shows key questions to determine the type of payment you should request.

For more information around the different types of payments and where to send requests, please read the AURORA FIS Bulletin: Honorariums, Fee for Service and stipends.

Please keep your original receipts for a period of 18 months to support the internal audit process. Research and other departments with external funding requirements will be responsible to hold their original receipts as outlined in the funding agreement.

Original receipts must be available to submit to Finance if requested. An original receipt is a hard copy of the receipt as presented by the supplier. If the receipt was issued in an electronic format, please print a hard copy of the receipt and maintain with your original hard copy receipts to submit to Finance if required.

Cheques may be picked up by employees of VIU only. Please remember to bring your employee ID if you are picking up a cheque.

If you have selected the “Hold for pickup in Accounts Payable” option on your Payment Requisition form, you will be notified by email when your payment is ready. Emails are generally sent out Wednesday afternoons. Once you have been notified your payment is ready, you may pick up your cheque on Wednesday between 1:30 – 3:30 or Thursday between 1:30 – 3:30. Please adhere to these timeframes in order to minimize disruptions to the Accounts Payable department and ensure we will have staff on hand to assist you.

If these times are not convenient for you, please remember having your cheque sent via inter-campus mail is always an option, and may ultimately be faster/more convenient for you.

Petty cash

Petty cash funds are issued on a business requirement basis as authorized by the Finance department. This section provides information regarding the issuance, reconciliation, replenishment, safekeeping and process to close out a petty cash fund and petty cash float.

Petty cash is an amount of money which is advanced to you “in trust.” There are two types of petty cash:

- Petty cash Fund: Ongoing small purchases for your department (not to exceed $100 per transaction or item)

- Petty cash float (cash float): Ongoing or temporary cash float(s) to provide change, etc. for your regular cash receipting operations

Petty cash fund reimbursement restrictions:

- Reimbursement of meals or travel (reimbursement to be claimed via the VIU Employee Expense Claim form)

- Reimbursement of items in excess of $100 (purchases to be made via the VIU Purchasing Card or VIU Purchase Requisition)

- Reimbursement of non-allowable expenses such as gift cards, donations and liquor

- Reimbursement of third party payments such as fee for service or honoraria:

- Fee for Service – payment to be issued directly to the payee

- Honoraria – payment to be issued directly to the payee via payroll

You are responsible for all petty cash fund and cash float amounts issued in your name.

You must account for the full amount of the petty cash fund by turning in receipts to be charged to your work order or returning the cash (or a combination of the two equaling the total of the fund issued).

Expenses are not charged to your work order until receipts have been submitted and processed by Accounts Payable.

If you are no longer the person responsible for the petty cash fund, the fund should be reconciled and closed.

- Prepare a Payment Requisition form in your name outlining the details of the petty cash fund requirement

- The account for the issuance of the fund is GL Account 1030

- Email the Payment Requisition form (Excel format) to your dean or director for authorization

- Have your dean or director provide their authorization via email direct to generalaccounting@viu.ca. The dean or director should include the Payment Requisition form with their approval email.

- A cheque will be processed in your name and returned to you. Cash the cheque at your financial institution.

- Keep your petty cash funds in a secure area such as a safe or locked cabinet

For petty cash funds (ongoing small purchase reimbursements):

- The purchaser will be required to submit the following to the petty cash fund holder:

- A completed Petty Cash Voucher authorized by the appropriate signatory

- Original detailed receipt showing items purchased and taxes (credit card slips are not acceptable)

- Note: you cannot sign for your own purchases

- The petty cash fund holder will reimburse the purchaser

- Keep the receipts with your fund until such time as your cash is low and you need to replenish your fund

- To request reimbursement, complete the Petty Cash Reimbursement form for the total of the receipts

For petty cash floats:

On a daily basis, as you are “cashing out” your transactions, count your cash float and ensure that the float reconciles to the original float balance.

When you find that your petty cash fund is low, complete the Petty Cash Reimbursement form for the total of the receipts on hand to replenish your fund.

Email the Petty Cash Requisition form, authorized Petty Cash Vouchers, and detailed receipts to your dean or director for approval to request a cheque to replenish your fund. Have your dean or director provide their authorization via email directly to accounts.payable@viu.ca. The dean or director should include the Petty Cash Requisition form, authorized Petty Cash Vouchers and detailed receipts with their approval email.

If you are no longer the person responsible for the petty cash fund, the fund issued in your name should be reconciled and closed. See “How do I close out my petty cash fund or float” for instructions.

If there is still the requirement for a fund, a new fund should be requested in the name of the new fund holder. See “How do I request a new petty cash fund or float?”

If you no longer require your petty cash fund or float or you are no longer the person responsible for the fund, the fund should be reconciled and closed as follows:

- Deposit the remaining cash to GL Account 1030

- Fund holders at the Nanaimo campus would deposit the funds at the Nanaimo Cashier. A receipt for the deposit will be provided.

- Fund holders at a regional campus would deposit the funds via the Revenue Deposit process

- Complete the Petty Cash Reimbursement form for any receipts on hand

- Indicate on the form that you are closing your fund and no payment is required

- Prepare an email to your dean or director of the area responsible for the fund to request authorization for the expenses and the closing out of your fund

- Attach the Excel copy of the Petty Cash Reimbursement form to the email

- Attach a PDF document of the authorized vouchers and detailed receipts. Multiple vouchers and receipts should be grouped and scanned to a single PDF and attached to the email

- Have your dean or director provide their authorization via email directly to accounts.payable@viu.ca. The dean or director should include the Petty Cash Reimbursement form and PDF of authorized vouchers and detailed receipts with their approval email.

Finance Forms contains the current Petty Cash Reimbursement Form.

The Petty Cash Reimbursement form should be completed by the fund holder. The fund holder is responsible for all petty cash and cash floats issued in their name.

The form should be authorized by the dean or director of the area responsible for the fund.

When you find that your petty cash fund is low, complete the Petty Cash Reimbursement form for the total of your receipts on hand to replenish your fund.

- Complete your Supplier ID in the Payable To field (leave blank if unknown)

- Complete the Petty Cash Fund holder name (your name) in the Supplier Name field

- Indicate the cheque distribution option (To be returned to requisitioner/hold for pickup in Accounts Payable)

- Complete the yellow cells on the form using a row for each receipt. Include the date of the reimbursement, a description of the item and record the Account, Work Order and Activity code. Enter the total of the reimbursement paid in the total column, and enter the GST and PST included in the reimbursement. The form will auto calculate the subtotal before GST and PST. Continue entering this information until all receipts are included and the payment request agrees to the total amount of the receipts.

- Complete the reconciliation on the form to ensure your fund is reconciled and you can account for the full amount of the funds issued

- Fill in the Requisitioned by, Date and Reviewed/approved by fields

- Save a copy of the completed form as an Excel document using the naming format “PCash Last name, First name MM-DD-YYYY” (i.e. PCash Smith, David 03-15-2021)

This video shows the process:

Petty Cash Reimbursement Form - video

Once you have completed the Petty Cash Reimbursement form:

- Prepare an email to your dean or director of the area responsible for the fund to request the authorization of your Petty Cash Reimbursement

- Attach the Excel copy of the Petty Cash Reimbursement form to the email

- Attach a PDF document of the authorized vouchers and detailed receipts. Multiple vouchers and receipts should be grouped and scanned to a single PDF and attached to the email

- Have your dean or director provide their authorization via email direct to accounts.payable@viu.ca. The dean or director should include the Petty Cash Reimbursement form and PDF of authorized vouchers and detailed receipts with their approval email.

Please allow two weeks for processing. Extra processing time may be required during holiday and peak periods.

Cash your cheque at your financial institution and replenish your fund.

Please keep your original receipts for a period of 18 months to support the internal audit process. Research and other departments with external funding requirements will be responsible to hold their original receipts as outlined in the funding agreement.

Original receipts must be available to submit to Finance if requested. An original receipt is a hard copy of the receipt as presented by the supplier. If the receipt was issued in an electronic format, please print a hard copy of the receipt and maintain with your original hard copy receipts to submit to Finance if required.

Original receipts must be available to submit to Finance if requested.

General Ledger corrections (non-payroll)

If a business unit, area or department identifies a transactional error, the means to having this corrected will be to populate the Journal Entry Voucher Request Form to be obtained from Financial Services.

Requests for corrections will be considered on a case by case basis by the finance area responsible for posting the originating transaction.

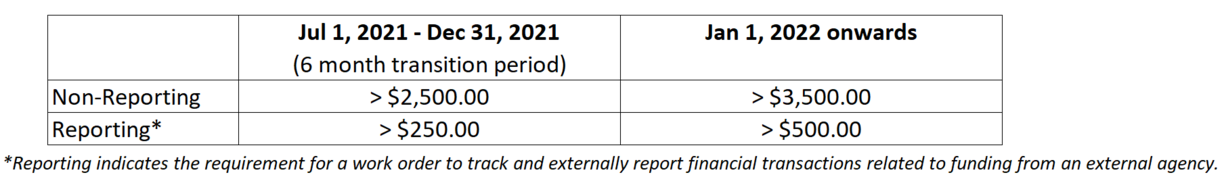

Requests for corrections will be considered only if the dollar amount of the correction exceeds the following thresholds:

Submit a request for a correction

- Complete the Journal Entry Voucher Form. Instructions on completing the form can be found in the “Instructions” tab of the form.

Finance Forms contains the current Journal Entry Voucher Form

After opening the downloaded form, click the "Enable content" button to allow full functionality:

- Send the completed form in Excel format to the appropriate approver(s) via email.

- Have the appropriate approver(s) provide their authorization via email. Approvers should email their approval direct to generalaccounting@viu.ca with the Excel form attached.

- The appropriate finance area will review the request and post the correction if the threshold criteria is met.