For extra assistance contact AcctsRec@viu.ca or a Tech Champion in your area.

See Glossary for definitions of new terms.

See menu under "Employee training" on this page for all categories of training materials. We continuously update as we progress through the implementation and updates of this system.

Most downloadable documents have been set for legal size paper in landscape mode.

See bottom of this page for Zoom training session recordings and related materials.

See Self-assessments for onboarding tools to help your team with Employee Portal training.

Use the FRS to FIS coding generator tool to find your Work Order, Act/Intake, Account and Product Codes!

Here is a Sales cheat sheet for an overview of the basic steps and a list of what you need before creating your Sales Order.

Information for Onboarding financial employees is on the main Finance training page.

Read the New user experience - sales chart to better understand the changes to your processes for recording and accounting for sales.

Tips for watching training videos

- Enlarge videos by clicking on arrows in bottom right of the video

- Click on the 1x on the bottom of the video to adjust the playback speed faster or slower.

- Closed captions can be turned off in the larger view by clicking the "cc" on the bottom of the video.

- For specific video instructions such as accessing a Payroll/HR report or your Payslip, see the appropriate page on the training website. More details are on the AURORA landing page or use the menu under Employee training.

Overall VIU revenue structure

This document contains the whole VIU revenue structure and the flow of revenues by source.

A1. VIU Institutional revenue map

This document is best printed on legal sized paper in landscape mode.

Decision guide for grants, contracts, scholarships and bursaries (with T4A implications)

The document below provides clarification on what constitutes:

- Contract vs. sponsorship vs. scholarship and bursary.

It also clarifies which situations will require the student receive a T4A.

B1. Decision guide for grants, contracts, scholarships, bursaries - T4A decision matrix

This document is best printed on legal sized paper in landscape mode.

Customer and sales basics

This is a video provides a general walk through of sales to cash functionality indicating:

- Sales Orders function to request invoices be sent out, the customer master file and where reports live.

- Areas use Customer and sales menu tab. Main item is Sales Orders which is a billing function and this includes billing for grants and contracts.

- Customer master file is a key item allowing you to see who exists in the system and their details.

- Brief explanation of item Maintenance of open items which allows you to view what amounts have been invoiced to a customer, including historical.

- Statement of account - this is not currently available to area representatives.

- Reports - updated information on Finance Reports. Video shows a rough overview of how to view and export a report.

- Tip on how to close multiple open tabs using the hamburger icon.

Sales to cash walk through - video

These videos outline in general what a Sales Order is, which fields need to be populated with content, and the correct content to enter into those fields.

Sales Order basics part 1: Sales Order fields - Sales Order tab - video

This video presents an overview of the fields on the Sales Order screen under the Sales Order tab.

Sales Order basics part 1 - Sales Order fields and Sales Order tab - video transcript.txt

Sales Order basics part 2: Sales Order fields - Delivery tab - video

The following video articulates the purpose of the Delivery tab fields on a Sales Order. In particular, its focus is on the Invoice "Text area" and the purpose of the "Original invoice number."

Sales Order basics part 2 - Sales Order fields - Delivery tab - video transcript.txt

Sales Order basics part 3: how to create a Sales Order - video

The following video outlines the basics for how to create a Sales Order.

Sales Order basics part 3 - how to create a Sales Order - video transcript.txt

The information below outlines the key differences between a regular Trade Sales Order and a contract/grant based Sales Order.

The main differences are:

Contract name and location

- Contract, grant funding letter, or service agreement must first be saved to the customer master file as a PDF

- Contract, grant funding letter, or service agreement PDF must be named according to the name of the document as stated on the document eg. AVED 12068 or if this is not available, by the source (customer) and date of the contract eg. Joe Smith Inc 16 Mar 21

- The PDF document name included in the customer master file must be the same name as entered in the External order ID on the Sales Order

- If the contract/grant funding letter or service agreement is being used to pay student SLED accounts, this must be the contract/grant funding/service agreement name entered into the payment comments within SLED

Note: The current training documentation currently indicates that all sales orders for AVED grant funding will be created by Treasury. However, as processes stabilize, the responsibility for the creation of Sales Orders for AVED funding (except the core operating grant) will shift to the appropriate business areas. The processes and video will be updated in the future to reflect this shift in responsibility.

Sales Order dates:

- Delivery date field must be used for the date of the start of the contract, grant, service agreement or funding letter

- Follow-up date field must be used for the end date of the contract, grant, service agreement or funding letter

Sales Order products:

- If you have a contract, grant funding letter or service agreement, then you must use the Grants & Contracts suite of products.

- The appropriate product to select will be by the source or type of customer. That is, you would select the product based on the type of organization it is.

For example: if I have a Ministry of Advanced Education contract, then select Grants and Contracts - BC Prov. Govt - AVED

Options of types include:

- BC Provincial Govt - AVED

- BC Provincial Govt - Non AVED

- BC Crown Corps

- Federal Govt Departments

- Municipalities, School Districts, Post Secondary Institutions

- Corporations

- Individuals

- The correct product must also be selected for tax. This will be specified in the terms of the agreement.

GL analysis:

- The "Act intake" will default to 900 Deferred revenue. This must be left as is.

- Grant award field must be populated. You must select the Source/Type again. In this case, it is a more specific list, but it is identical in structure to the Sales Order product options.

Contract and grant Sales Orders: main differences between regular Trade Sales Orders - video

These items explain the procedure for having a new customer created to facilitate the creation of a Sales Order.

E1. Creating or amending a customer and creating a new product processes

This document is best printed on legal sized paper in landscape mode.

The New and Existing Customer Request Form is available from Finance Forms.

Customer master file basics part 1: purpose and location - video

This video outlines the purpose of the customer master file, when to look at it and how to search it. The customer master file is read-only by areas other than Finance. Always ensure there is a customer master file before attempting to create a Sales Order.

Customer master file basics part 1 - purpose and location - video transcript.txt

Customer master file basics part 2a: fields and their purpose - video

The following video outlines the customer master file fields from the perspective of an area or departmental financial representative:

- The customer must be in the system to create a Sales Order

- Customer tab details (Customer groups, Customer identification and Notes)

- Contact information details (ensure address is correct)

- Invoice tab (relevant for Treasury only)

- Payment tab (useful if a refund is ever required)

- Relations, and Action overview tabs (relevant for Treasury only)

- Credit information tab (mostly relevant for Treasury only)

Customer master file basics part 2a - fields and their purpose - video transcript.txt

Customer master file basics part 2b: documents and retention - video

The following video covers document retention requirements and document folders in the customer master file such as sales contracts and customer invoices. grants and contracts require appropriate documents to be attached to the customer master file using the paperclip icon. A blue icon indicates there are documents attached. Wire transfer information (for international refunds) is also stored in these folders.

Customer master file basics part 2b - documents and retention - video transcript.txt

Customer master file basics part 2c: fields and their purpose for Treasury Finance (1) - video

The following video outlines the Customer tab on the customer master file plus additional details on the customer master file that are relevant to the Treasury team.

Customer master file basics part 2d: fields and their purpose for Treasury Finance (2) - video

The following video describes the customer lookup functionality (with good detail on how to look up a customer using the Value lookup functionality, including advanced search), the Contact information tab (incl. for internal sales addresses), the Invoice tab and the Payment (for refunds) tab of the customer master file.

Customer master file basics part 2e: fields and their purpose for Treasury Finance (3) - video

The following video outlines from a Treasury perspective, the Relations tab (and how to populate these fields), Action overview (not active on initial rollout), Credit information as well as the "Document archive" where contracts, service agreements, and funding letters need to be saved.

Customer master file basics part 3: Customer Creation form - video

The following video explains how to populate the New and Existing Customer Request Form (found on Finance Forms), and how to have a customer created or amended in the FIS in the customer master file by sending the above form to Accounts Receivable.

Customer master file basics part 3 - customer creation form - video transcript.txt

The following video explains the procedure to create a new Sales Order product. This would only happen in very rare cases. Normally, the Treasury supervisor and/or manager would direct the enquirer to the appropriate existing product within the system.

E1. Creating or amending a customer and creating a new product processes

This document is best printed on legal sized paper in landscape mode.

The New Sales Product Request Form is available on Finance Forms. You can see a list of all current sales products in the Sales Product Listing report in the folder under Accounting -> Across companies -> Shared -> Area Special Purpose Finance Reports accessed on the home screen in the Employee Portal.

New Product Creation form - video

This video outlines at a general level what to do if an error or adjustment is required for a Sales Order.

You are able to open your Sales Order to make changes after saving it. However, only if it has not been approved through workflow yet! Prior to making changes, you need to determine where the Sales Order is in workflow. Watch the workflow videos for a clear understanding of how to use Workflow Enquiry to determine what step the Sales Order is in before you attempt any changes.

If necessary, contact the Treasury team and explain what change is required to see if it is appropriate for you to go back in and adjust it. It will depend on what stage the Sales Order is in to determine how to best make adjustments. Be sure to watch the full set of workflow videos in the next section that explain what steps are taken if something needs adjusting so any adjustments will flow through workflow smoothly.

If a Sales Order needs to be cancelled and it has not finished workflow, please let AR know so they can reject the Sales Order back to you. Once the Sales Order has been rejected, set the status of the Sales Order and each product line to Closed and then click Save. This will stop the Sales Order from being processed.

If a Sales Order needs to be cancelled and it has gone through workflow and is finished, you have to let AR know and they will reverse the Sales Order.

See Workflows section below to learn how to enquire on a Sales Order's workflow status.

Sales Order adjustments and errors: basics - general - video

Sales Order adjustments and errors: basics - general - video transcript.txt

Each Sales Order submitted to Treasury will require the appropriate supporting documentation be attached to it. In the absence of the appropriate supporting documentation, the Sales Order will not be processed. The following indicates what the required supporting documentation consists of.

Each Sales Order requires the appropriate approvals in order for the Sales Order to be processed and recorded.

- Every Sales Order requires an attached email approval in PDF format (be sure not to attach a Portfolio PDF. Only single PDFs - not batches of different emails rolled into one Portfolio PDF - can be understood by the system)

- The Sales Order approver cannot be the same as the Sales Order creator

- The Sales Order approver must have signing authority on the Work Order the Sales Order relates to

- If the Sales Order creator has signing authority on the Work Order, the Sales Order must be approved by a person with a higher signing authority limit than the Sales Order creator (see One Level Up approval)

- If signing authority limits are the same, we need other verification to establish the approver is considered one level above the creator (i.e. in Finance, the director and AVP have the same signing authority amount, however, based on their positions, we can see one is one level above the other)

- At this time, we are not comparing the signing authority limit to the Sales Order amount because these limits are due to be revamped

- You can have multiple approvals on one email if necessary

This video outlines how Sales Orders are approved and what constitutes appropriate approval.

Sales Order approval - video

We are looking for:

- Company

- Work Order number

- Specific amount (if possible)

- Relevant tax (GST, PST, GST & PST or other)

- Some information about what the sale is for

- Dates if it’s a contract

We will also work with you when you submit the approvals to determine what additional details we need, if any.

To reduce the chances of your Sales Order being rejected back to you for changes, it is best to have the most accurate number possible in your approval including which taxes. Please provide the before-tax amount and which taxes are applicable.

- Instead of saying: VIHA: Approx. $194 or $194 plus tax

Say: VIHA: $194 plus GST

Please attempt to determine the appropriate tax rate prior to obtaining email approval and creating the Sales Order. Past invoicing or other departments with similar activities are good reference points for this. If you are really uncertain, feel free to contact Accounts Receivable to ask us.

We also realize there may be restrictions on your ability to do this and mistakes can still happen. If you submit a Sales Order with approval for $125 + GST, and we reject the Sales Order back to you because it needs to be GST and PST based on the other supporting documents you have attached, we will not require a new approval email to be obtained and attached.

The ideal is an individual email approval per Sales Order, however, if you combine multiple Sales Order approvals into one email and still provide the required information as listed in the above FAQs, we will accept that.

Remember to still be as specific as possible for amounts. It would be helpful if you could identify which taxes also. So saying $125 + GST is more useful to us than saying $131.25 incl. tax or ~$130 incl. tax.

The email approval step is an interim measure and is still a requirement. The email approval is not considered “supporting documentation” since in the future the approval will become part of the workflow process occurring within the system. So for now, please include approvals as mandatory as part of our interim process.

First, be sure you are waiting (up to 10 seconds) for the "Document archive" to load after you click on the paperclip icon.

Use the Chrome browser.

If you have trouble attaching documents the standard way with the window popping up, you can try the alternate “drag and drop method”:

1. Locate the file in your Windows Explorer and keep that window open on your desktop or one of your monitors if you have more than one:

2. In FIS when you have the Sales Order open, click the paperclip icon so the "Document archive" window opens - be patient and wait:

3. Drag your file from Windows Explorer and drop it anywhere in the "Document archive" screen. You will receive an “Add a document” prompt. Select the appropriate Document type (mandatory) and enter in a document description (optional). You may need to wait a few seconds. Click Save.

4. You should now see your document in the "Document archive"

Click the X at the top right corner of this window to return to your Sales Order. You will see the paperclip icon now has a blue box indicating a file is attached.

The ability to delete documents has been restricted for audit reasons.

a) If you have attached a document in error and you have not yet saved your transaction, you will need to clear your transaction and start over.

b) If you have already saved your transaction, you will need to inform either Accounts Receivable (Sales Orders) or Procurement (Purchase Requisitions & Goods Receipts) that an incorrect document was attached. Accounts Receivable or Procurement will then reject the task back to you in workflow, at which point you will have the option to either:

- Close the Purchase Requisition or Sales Order and start over, or

- Rename the incorrect document as “Document to be deleted” and then attach the correct document, if applicable. Accounts Receivable or Procurement will submit a request to remove the document to be deleted, if applicable.

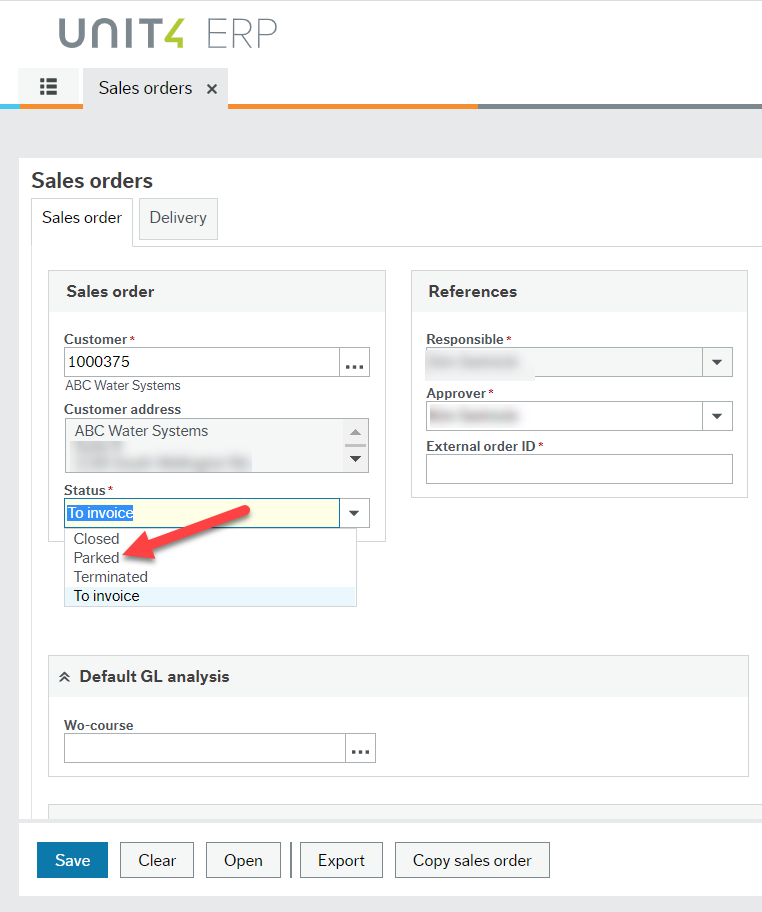

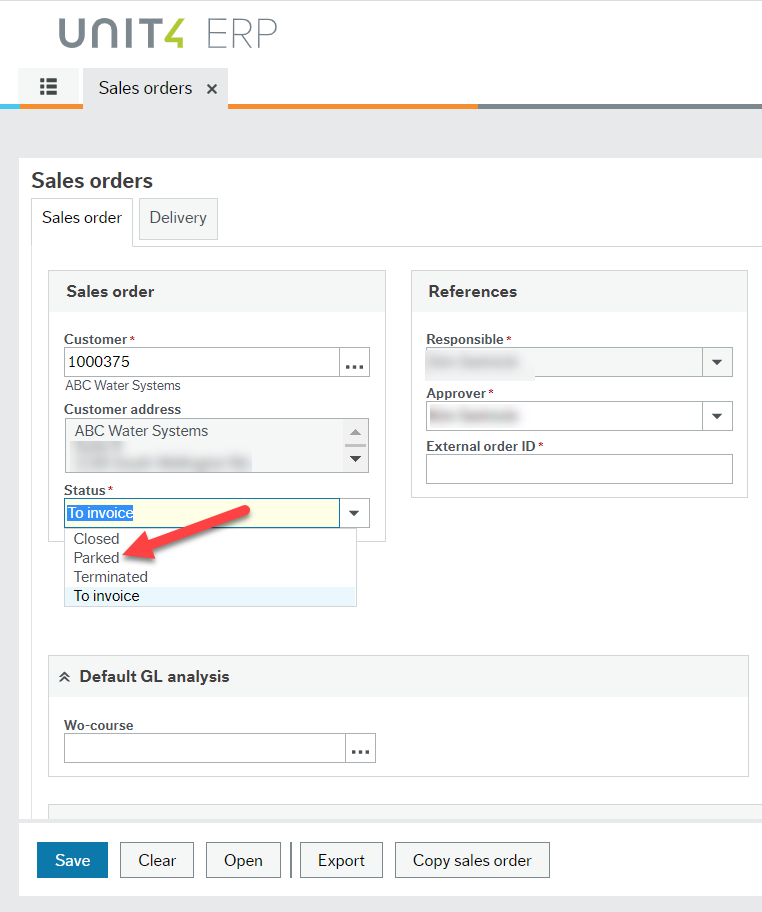

If you mark your Sales Order as parked (by clicking the dropdown in the top left), the Sales Order will not go through workflow so it will not get processed.

You may park a Sales Order if you intend to reopen it and complete it at a later time. Once you reopen it, you can make your adjustments and then change the status (see the Status dropdown list in the image above) to Active. When you click Save the Sales Order will then go into workflow.

Parking a Sales Order is not recommended unless you get interrupted while creating the Sales Order. It is recommended you have all of the information needed before you create your Sales Order. If a Sales Order is parked and is subsequently forgotten, it will always remain unfinished in the system.

Unlike with purchase requisitions, you will not see this option anymore to park individual items on a Sales Order. If you need to park a Sales Order (i.e. you have been interrupted and need to complete the Sales Order at a later time), you should change the status at the Sales Order header level (by clicking the dropdown in the top left) instead.

Enter the relevant text in the “Additional product information” field (i.e. A deposit of $100 is due by Sept 1, 2021).

If there is no contract you enter “No Contract” in this field.

If you have a contract, grant or service agreement, you enter the name of the contract, grant or service agreement file that was uploaded in the customer master file. The name you enter in the External order ID field must match the file name of the contract. You decide on the name, but it needs to be relevant to the contract. If you are unsure of how to name it, we suggest putting the customer name and date of the contract: “School District 63 – February 1, 2021-January 7, 2022.” You may also add “Hairdressing” to the description so you can identify this one versus other programs.

These 2 fields are important. For orders with a contract, grant or service agreement it is important to fill in these fields correctly because they:

- help identify which contract relates to each Sales Order and

- they identify deferred revenue for year end.

See the video Sales Order basics part 1: Sales Order fields - Sales Order tab – video at 5:00 mins.

- Period and Order date should remain as populated

- Delivery date = starting date of the contract

- Follow-up date = end of contract

For “No Contract” or Trade Sales Orders, leave all four fields as they are populated with the current date.

As soon as a user submits a Sales Order it proceeds to the AR Treasury team for review. Managers and deans need to provide their approval before the Sales Order is created/submitted to AR Treasury.

Any user can see any Sales Order if they have the Sales Order number.

As soon as a user submits a Sales Order, it proceeds to the AR Treasury team for review. Managers and deans need to provide approval before the Sales Order is submitted to AR Treasury. If an error is noted by AR Treasury, the Sales Order will be rejected and returned to the creator with comments for it to be fixed.

When a customer contacts a Sales Order creator to request a refund, the Sales Order creator needs to collect the payment information and provide this to AR Treasury.

Previously, you may have submitted two separate invoice requests; one for each payment. In FIS the process is similar.

Firstly, note that products are not to be used for deposits. For a sale of $10,000 with 10% expected as a deposit, one product for $10,000 should be used and the deposit should be noted in the “Additional product information” field as “Deposit of 10% to be made on Sept 1” for example.

For a contract with multiple payment steps, a Sales Order should be created as each payment is due. If you have a contract with 6 monthly payments, then create 6 different Sales Orders and be sure to reference in the “Additional product information” field that this is payment 2 of 5, etc.

Ensure that you have referenced the contract name (that is attached to the customer master file) in the External order ID field as per the normal Sales Order process.

An “Act-Intake error” message indicates that you are either missing an “Act-Intake” code or you have an invalid “Act-Intake” code for one of the sales product lines.

When creating a Sales Order, if you update the Act/Intake after entering the first line, but before entering subsequent lines, the system will copy the Act/Intake into subsequent lines as they are entered. However, if you enter all lines first, before entering the Act/intake, or there are different Act/Intakes on separate lines, then you will need to check the GL analysis for each line.

If the Sales Order has not yet been posted (do an enquiry) you can open it by going to the Sales Order menu, click Open at the bottom, find your Sales Order and then change the status from “To invoice” to “Closed” by using the dropdown menu. Then click Save.

If the Sales Oder has been posted you will need to request a reversal. You can tell what the status of the Sales Order is by going to the Sales Order menu, clicking Open and then finding your Sales Order. Review the “Status column”:

- F and D indicate that the Sales Order has been posted

- N indicates that the Sales Order has not been posted

- C indicates that the Sales Order is closed

If you have contract funding that pays for a specific group of students, the appropriate steps are as follows:

- Create a Sales Order for the grant funding

- Complete a Contract Details Form to apply the funding to the specific students and attach this to the Sales Order

The fiscal or accounting period will default to the current period. You do not need to change the period from the default.

You will notice that the period terminology in FIS differs from FRS. In FRS, the periods were labelled as “1”, “2”, “3”, etc. In FIS, the periods begin with the ending year followed by the period number (two digits). For example, for the fiscal year 2021/2022, July 2021 would be “202204”. See the below chart for a reference guide. As we converted to FIS on July 2021, the first quarter (April through June) uses the old FRS period terminology.

Deferred revenue and revenue recognition - New Jul 2022

The document below provides an overview of the deferred revenue and revenue recognition process for grant and contract funding in FIS.

Grant and contract funding - deferred revenue and revenue recognition

Domestic revenue, AR and cash handling processes

A regular Trade Sales Order is one that bills a customer for services or merchandise. However, it does not result from or include a contract, grant or sponsorship agreement. Here is information to walk through all of the steps involved in:

- requesting,

- creating,

- adjusting, and

- refunding Trade Sales Orders.

C1. Regular Trade Sales Order process

C2. Trade Sales Order Products listing

Trade Sales Order products - video

Trade Sales order products - video transcript.txt

Creating a Trade Sales Order - video

Creating a Trade Sales order - video transcript.txt

Processing a Trade Sales Order - video

Processing a Trade Sales Order - video transcript.txt

Adjusting a Trade Sales Order 1: Sales Order has not been posted to the GL - video

Adjusting a Sales Order 1 - not posted to the GL - video transcript.txt

Adjusting a Sales Order 2: Sales Order has been posted to the GL - adjusting down - video

Adjusting a Sales Order 2: Sales Order has been posted to the GL - adjusting up - video

Adjusting a Sales Order 2: Sales Order has been posted to the GL - write offs - video

A Sales Order for a 3rd party contract is one where a signed contract/service agreement already exists with the Customer that will receive an invoice to pay VIU according to the terms of the contract. There are special nuances to these Sales Orders. This will contain a walk through of all the steps in:

- requesting,

- creating,

- adjusting, and

- refunding sales orders for domestic 3rd party contracts.

D1. 3rd party contract processes

D2. 3rd party contract products listing

This document is best printed on legal sized paper in landscape mode.

Note that the email approval step is an interim measure and is still a requirement. The email approval is not considered “supporting documentation” since in the future the approval will become part of the workflow process occurring within the system. So for now, please include approvals as mandatory as part of our interim process.

Processing a 3rd party contract without SLED implications - video

Processing a 3rd party contract without SLED implications - video transcript .txt

A Sales Order for an external sponsorship is where a signed sponsorship agreement exists with a party that will be paying a specified students' costs on behalf of the student. A Sales Order for an external sponsorships requires a signed sponsorship agreement as well as specific inputs into the actual Sales Order. This section will contain a walk through of all the steps in:

- requesting,

- creating,

- adjusting, and

- refunding Sales Orders for Domestic External Sponsorships.

F2. External sponsorships processes

D7. External sponsor invoicing product listing

These documents are best printed on legal sized paper in landscape mode.

External sponsor invoicing part 1: basic sponsor billing - video

External sponsor invoicing part 1 - basic sponsor billing - video transcripts.txt

Per the terms of a contract, grant, or trade arrangement, there are times when an initial deposit payment is required in advance of the main invoice. When a deposit is requested from a customer, this must be noted on the Sales Order.

This document is best printed on legal sized paper in landscape mode.

An internal Sales Order is where the Sales Order is not sent to the customer, but the receivable amount is still recorded in the system. When a Sales Order is approved and created, the Treasury team's default action is to distribute/send the Sales Order to the customer. This is referred to as an internal invoice.

To ensure that an invoice is not distributed, simply add the comment: "Do not invoice" on the Additional product information area of the Sales Order.

Under very limited and pre-approved circumstances, invoices/Sales Orders are sent to US customers in US dollars. In these situations the Sales Order must be set-up with the correct currency. The following describes how to do this.

This document is best printed on legal sized paper in landscape mode.

An area or department within VIU may wish to use Eventbrite to facilitate an event. If this event charges attendees a fee, the steps the area must follow are:

This document is best printed on letter sized paper in landscape mode.

A domestic internal scholarship and bursary (cost centre payment) is where an area or department within VIU elects to pay one or more students' costs. The appropriate Cost Centre Payment form must be populated and submitted to Finance Accounts Receivable/Treasury group.

Update under Where can I find the Cost Center Student Payment Form? below indicates:

- The “Cost Centre Student Payment Form” referred to in the training documentation has been renamed “Work Order Payment Form for Scholarships and Bursaries” and is available on Financial Services Forms.

The following is the process for facilitating these types of payments.

E6. VIU internal scholarship and bursary (cost centre payments)

This document is best printed on legal sized paper in landscape mode.

VIU internal scholarship and bursary: tuition credit - video

VIU internal scholarship and bursary: tuition credit - video transcript.txt

VIU internal scholarship and bursary: cash equivalent - video

VIU internal scholarship and bursary: cash equivalent - video transcript.txt

VIU internal scholarship and bursary: monetary disbursement - video

VIU internal scholarship and bursary: monetary disbursement - video transcript.txt

In certain circumstances, VIU will pay an employee's VIU tuition to complete VIU courses. This may arise based on a decision from a department or be part of a union contractual arrangement. Follow this process to ensure this is recorded accurately:

E5. VIU paid tuition - employee tuition

This document is best printed on legal sized paper in landscape mode.

Employee tuition paid by VIU - video

On an ad hoc basis, emergency student loans are distributed from Financial Aid via Finance Treasury to a student. The following are the procedures.

E3. Emergency student loan process

This document is best printed on legal sized paper in landscape mode.

Emergency student loan part 1: applying payment - video

Emergency student loan part 1 - applying payment - video transcript.txt

Emergency student loan part 2: applying the charge - video

Emergency student loan part 2 - applying the charge - video transcript.txt

Emergency student loan part 3: performing remittance - video

Emergency student loan part 3 - performing remittance - video transcript.txt

Operational requirements sometimes involve areas/departments to conduct cash sales. When this occurs, the area/department must create a Sales Order to record the funds collected. In turn, the Nanaimo Cashier Office requires specific information to accept and deposit the cash funds.

See the Finance Forms website for Cash sales on campus tracking sheet. Please keep your copies of receipts for reference if a refund is required or to resolve disputes, but you do not need to submit them to AR.

Note that in this video the customer account to use (departmental cash collections) is now 1001396. Be sure to choose the product code Other Revenue (4900-X) with the X being the appropriate tax category for the funds.

Cash sales on campus - video

When a petty cash float is to be closed, the residual funds in the float must be returned and redeposited into VIU's bank account.

Petty cash repayment processes:

In certain circumstances petty cash floats will need to be returned or surrendered back to VIU and be deposited into the main bank account. The process to complete this is as follows:

- Area financial representative surrenders remaining float balance to Treasury Finance.

- Treasury Finance deposits amount on separate deposit slip.

- Treasury Finance loads transaction onto appropriate Treasury Excelerator file and follows the regular process for Treasury Excelerators.

P-card personal expense repayment processes:

When a personal expense is processed on an employee's P-card, the following form needs to be completed, approved by the employee's manager, and submitted to the AR Treasury team along with a cheque for repayment:

The Purchasing Card Personal Expense Repayment form is available on Finance Forms.

Please see the decision guide at the top of this page under the heading:

Decision guide for grants, contracts, scholarships and bursaries (with T4A implications)

The “Cost Centre Student Payment Form” referred to in the training documentation has been renamed “Work Order Payment Form for Scholarships and Bursaries” and is available on Financial Services Forms.

Prior to COVID the university sector was steadily moving away from accepting cash payments for tuition. This movement gained momentum when in 2019 BC post-secondary institutions were identified in Perter German’s report as a vulnerable sector at risk of becoming a money laundering target. With the onset of COVID this shift was rapidly accelerated. Not accepting cash for student tuition has now become common practice.

With the movement away from the acceptance of cash, face to face cashiering services are no longer required. Experience gained during the COVID time period demonstrated that efficient service could be provided effectively without requiring face to face service.

The new FIS provides Finance with tools to adopt best practice revenue management principles. From a user perspective this means that the you will only see revenue in your Work Order when it is earned (vs when it is received).

Please read the AURORA FIS Bulletin: Grant and contract revenue recognition for a detailed description of revenue recognition concepts and an explanation of the process Treasury will follow.

See also Grant and contract funding - deferred revenue and revenue recognition document.

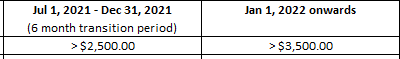

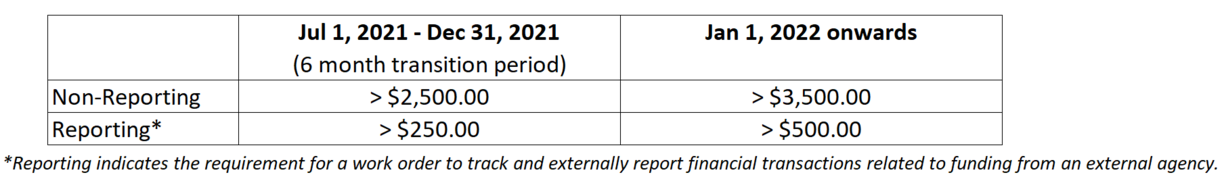

Areas with small volume internal sales will only be included in the phase 1 FIS if the amount ‘sold’ is over the minimum financial threshold noted below:

Departments have the option of tracking internal sales within their department. When the minimum financial threshold has been reached a combined single request may be submitted.

For example, multiple events or bookings can go on one Journal Entry Voucher form if it takes a few to reach the threshold (> $2500 to Dec 31, 2021 and >$3500 after Jan 1, 2022). This means that you may only end up submitting one transfer at the end of each summer, for example, if individual events/bookings do not reach the threshold. You will need to maintain your own tracking spreadsheet for this purpose.

The administrative cost of manually processing low dollar value transactions isn’t supportable given that no external revenue is generated with this activity.

For more information please read the AURORA FIS Bulletin: Internal sales.

We can appreciate that there are specific concerns with respect to seniors in the community. Research is showing that the pandemic was a catalyst bringing seniors and on-line banking together (as illustrated in the excerpt below from an article posted in Aug 2020.

"To reduce their risk of COVID-19 infection, many older Canadians are embracing online banking for the first time. Previously, they avoided it in favour of visiting their local branch or because they didn’t trust the technology. The pandemic has compelled them to step outside their comfort zone and give it a try.

It remains to be seen how many seniors make the switch and stick with it, but two examples from Canada’s big banks suggest there is significant interest. In April, CIBC had a 250% increase in clients aged 65-plus signing up for online banking. From mid-March to mid-April, RBC saw an 84% increase in seniors enrolling in online banking, and a 210% increase in digital activity by senior-age clients who were already enrolled but not actively using the service."

In the event that students of any age encounter issues making payments, we encourage them to consult the VIU website for more information, ask their main VIU contact for assistance, or reach out to Accounts Receivable for help at acctsrec@viu.ca. As a reminder, cheques are an accepted method of payment that many seniors are very comfortable with.

All students have a customer master file auto-created based on their student record in SLED. However, these are created under a specific customer group (SLED Student Amounts). SLED customers in FIS are synced to their SLED counterparts meaning that the activity under these customer accounts in FIS must match and reconcile to their student accounts in SLED. This means no Sales Orders can be created under their SLED Customer ID. If a Sales Order needs to be created under a student’s name, a New and Existing Customer Request Form (located on Finance Forms) must be filled out by the area and submitted to AR. A customer master file under one of the trade customer groups will be created, which allows for Sales Orders to be produced.

When agents are making a payment on behalf of a student, the Sales Order will need to be issued in the name of the agent, not the student. The student’s name should be indicated in the Description of the Sales Product. All AR open items are subject to monthly follow up with the customer as part of our collections processes, therefore the Sales Order must be issued to the person responsible for paying the invoice.

Yes, you will still need to submit a New and Existing Customer Request Form found on Finance Forms. Currently, the supplier master files (in the Procurement module) and customer master files (in the Customer and sales module) are separate and discrete, i.e. there are no mechanisms to allow one to inform the other. Although a business may be setup as a supplier in FIS already, we will require the business area to complete a New and Existing Customer Request Form (from Finance Forms) and submit it to AR for a customer master file to be created in order for Sales Orders to be issued.

Please provide a copy of your VIUSU quarterly billing spreadsheet (and supporting backup invoices) to generalaccounting@viu.ca. General Accounting will review the spreadsheet and supporting backup, and assist with creating a Sales Order to VIUSU until further training can be provided.

Yes. A Sales Order will always need to be created to recognize revenues, regardless of whether the customer requires a Sales Order. It is assumed that all Sales Orders created need to be sent to the customer unless "Do Not Invoice" is specifically noted in the Additional product information field.

Sales via POS Systems do not require Sales Orders to be created. Other processes have been developed to facilitate the accounting of revenues collected by POS. Sales Orders are required for items such as contracts, ITA revenues, and other one-off sales that are not processed by POS.

The business units that now have PayD have been informed of their new reporting processes. The business units that have existing POS Systems in place leading up to go-live have been informed of any changes in their processes required for the conversion. For business areas that have existing POS Systems, if no changes have been communicated by AR Treasury, please continue to follow existing processes.

Please see the Internal sales bulletin on FIS Bulletins.

For example, multiple events or bookings can go on one Journal Entry Voucher form if it takes a few to reach the threshold (> $2500 to Dec 31, 2021 and >$3500 after Jan 1, 2022). This means that you may only end up submitting one transfer at the end of each summer, for example, if individual events/bookings do not reach the threshold. You will need to maintain your own tracking spreadsheet for this purpose.

In the Additional product information field you can list out the relevant details of how the product amount has been calculated.

There are Other Revenue product codes to use if there is no clear choice:

4900-1 Other Revenue Non Taxable

4900G-1 Other Revenue Taxable (GST Only)

4900GP-1 Other Revenue Taxable (GST & PST)

4900P-1 Other Revenue Taxable (PST)

If the end user believes a new sales product is required please see How do I get a new Product created? above.

The process for rebate cheques is as follows:

- Complete a Sales Order for the rebate amount. In the Additional product information field indicate that “No Invoice” is required.

- Send the cheque to the Nanaimo Cashiers’ office separate from other deposits. Ensure that the Sales Order number is clearly indicated on the cheque.

- The Nanaimo Cashiers will process the cheque against the Sales Order and then deposit it in the bank.

The current training documentation currently indicates that all Sales Orders for AVED grant funding will be created by Treasury. However, as processes stabilize the responsibility for the creation of Sales Orders for AVED funding (except the core operating grant) will shift to the appropriate business areas. The processes and video will be updated in the future to reflect this shift in responsibility.

Please notify Treasury if there is incoming funding, but no Sales Order has been created yet. Please add this Treasury notification to your internal processes checklist.

If you have a Sales Order for items that are shared revenue with other departments (such as Hairdressing or labs), this detailed information should be attached to the Sales Order but does not need to be included in the email approval.

Yes, two different Sales Orders can be paid with one one single payment as long as they are:

- Sales Orders issued out of FIS

- Issued to the same customer

No. A quote is not a contract. A quote is only what we are offering, whereas a contract involves proof the other party agrees to accept the proposed offer. Please read over the PDF K3. Homestay Processes from the International Education revenue, AR, and cash handling processes section below.

You will need to attach an agreement or contract to the customer master file.

Workflows

The video below illustrates the levels of review a Sales Order goes through before it can be invoiced and distributed to Customers.

Sales Order workflow overview - video

As a Sales Order creator, workflow will automatically distribute your Sales Order to the Treasury team for review. If the Treasury team notes any issues with your Sales Order they will reject it with comments and workflow will send the Sales Order back to you to be fixed. The video below illustrates this process.

Workflow for Sales Order creators: rejections - video

Workflow for Sales Order creators: rejections - video transcript.txt

Workflow enquiry and Workflow user log can be used to determine what step of Sales Order workflow a Sales Order is currently sitting in, who it is sitting with, or if it has been completed. The video below illustrates this.

Workflow enquiry and user log: Sales Orders - video

Workflow enquiry and user log: Sales Orders - video transcript.txt

Once a Sales Order creator creates and submits a Sales Order, workflow will push it to the Treasury clerks for review. They will then review the document and either approve it onward to the Treasury final approver or reject it back to the Sales Order creator. This video illustrates this process.

Sales Order workflow for the Treasury team - video

Sales Order workflow for the Treasury team - video transcript.txt

Sales Orders can be changed up until they have completed the Sales Order workflow and the invoicing process has been completed. This video explains how workflow reacts to a Sales Order that is changed by the Sales Order creator or Treasury team after it is submitted, but prior to its being posted into the GL via GL07 process.

Sales Order workflow and Sales Order adjustments - video

Sales Order workflow and Sales Order adjustments - video transcript.txt

Email notifications will be triggered by workflow tasks (e.g. to notify you that you have a Sales Order task to action). It is recommended that you sign in at least once daily to see if you have any alerts or tasks to complete.

See the Orientation training page for more details on alerts and tasks if required.

Treasury & Finance specific processes

CBV is VIU's collection agency. On a daily basis, information on students arrives from CBV which must be updated within SLED. Then on a monthly basis a Sales Order must be created indicating the amounts that are receivable from CBV. The process to complete these steps is outlined here.

This document is best printed on legal sized paper in landscape mode.

Passport to Education is a program that continues to be honoured by a Provincial Ministry. The following process outlines how a students' SLED account is to be relieved if they present a Passport and how the billing is to be completed on a monthly basis.

This document is best printed on legal sized paper in landscape mode.

On a monthly basis, a Sales Order must be created within Finance to account for the GST rebate. This Sales Order would then be relieved as the GST rebate is received electronically into the bank from the Receiver General. The following articulates this process.

This document is best printed on legal sized paper in landscape mode.

If a student buys something from VIU and a Sales Order is issued, they will have both a Trade AR Customer account and SLED AR Customer account. When this happens, each bill must be paid separately in the appropriate system: Trade AR is paid in FIS while SLED AR is paid in SLED. The following document and video explains what to do if a single combined payment is received.

Multi-system payments (like SLED and UBW-FIS) - video

Multi-system payments (like SLED and UBW-FIS) - video transcript.txt

The following process document and videos outline how to issue refunds, which involves the AR Remittance process.

G6. AR Remittance functionality process

Remittance advice functionality - video

Remittance advice functionality - video transcript.txt

Remittance advice variants - video

Remittance advice variants - video transcript.txt

Remittance advice functionality with SLED - video

Remittance advice functionality with SLED - video transcript.txt

The following process documents and videos outline how to accept payments against Sales Orders.

E9. Naming convention for all payment types for Sales Orders

| Nanaimo Cashiers | ||||

| Payment type | Currency | Bank | Payment reference | Description (GL description) |

|---|---|---|---|---|

| Cheque | CAD | RBC-GEN | [Cheque number] | Cheque - NDDS 1000155 |

| EFT | CAD | RBC-GEN | [EFT number] | EFT - [Customer name] |

| Wires | CAD | RBC-GEN | Wire | Wire - [Customer name] |

| MasterCard | CAD | RBC-GEN | [First 4 digits, last 4 digits] | MC DEP 10644300 |

| Visa | CAD | RBC-GEN | [First 4 digits, last 4 digits] | VSA DEP10644300 |

| Cheque | USD | RBC-USD | [Cheque number] | Cheque - NDDS 1000158 |

| International Education Cashiers | ||||

| Payment type | Currency | Bank | Payment reference | Description (GL description) |

| Cheque | CAD | RBC-GEN | [Cheque number] | Cheque - NDDS 5000172 |

| EFT | CAD | RBC-GEN | [EFT number] | EFT - [Customer name] |

| Wires | CAD | RBC-GEN | Wire | Wire - [Customer name] |

| Note: Sales Order payments can only be processed by Nanaimo Cashiers at this time. It is the institutional preference that Sales Order payments are taken by cheque, EFT, or wire. If no other option is possible, credit card payments can be made over the phone as a last resort. | ||||

- Direct Deposit payment is an EFT

- Bank Draft is a cheque

E9.1 Sales Orders payment receipt rules

Payment acceptance rules in UBW FIS - video

Payment acceptance rules in UBW FIS - video transcript.txt

Payment acceptance functionality in FIS: generic - video

Payment acceptance functionality in FIS- generic - video transcript.txt

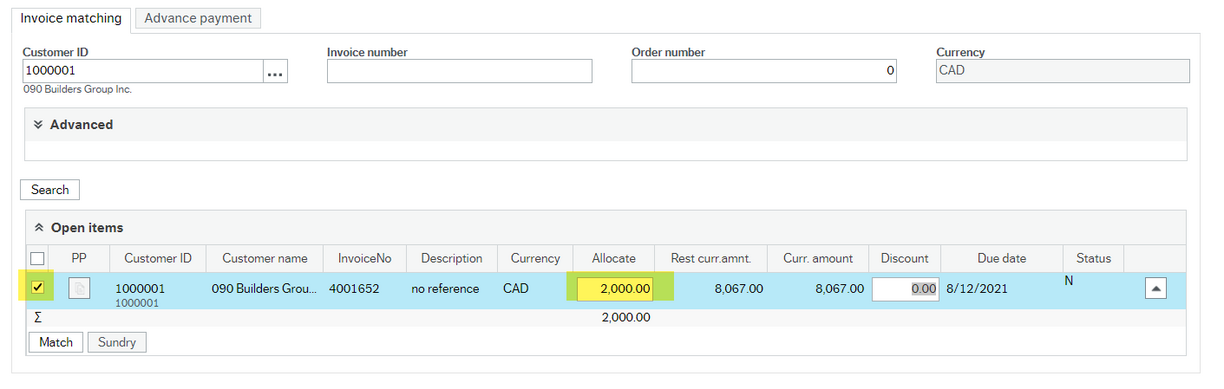

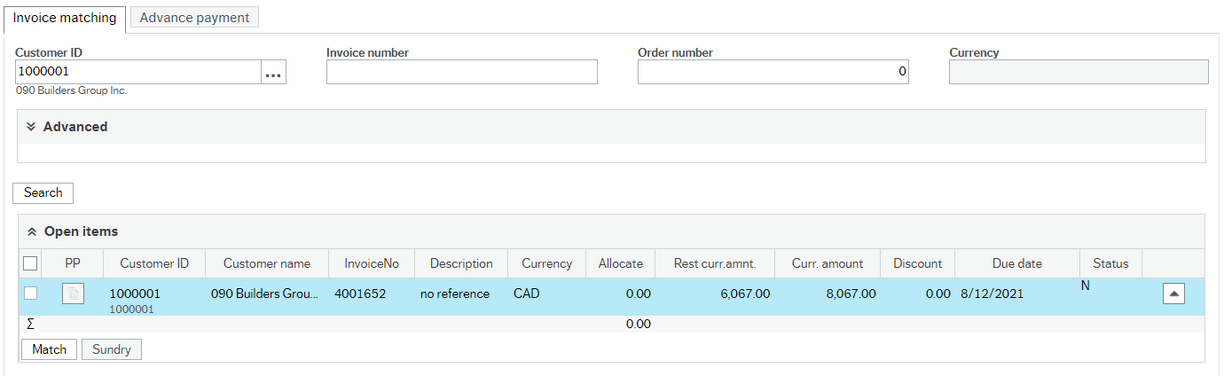

If multiple payments are being applied against one Sales Order, the user must adjust the “Allocate” amount on the Open item that they are applying the payment to in order to balance the entry.

For example, below you can see the customer has an open item of $8,067.00; however, they are only paying $2,000.00 in the first payment. Select the line item (so it turns blue) and change the “Allocate” amount to $2,000.00. Then you can select “Match” and then save the transaction.

Advance payments process

When a payment is received that exceeds the amount owing on the Sales Order(s) being paid, an advance payment can be posted to the Customer account.

*Note that VIU has the option of returning or rejecting the payment back to the customer instead of posting an advance payment. This is the preferred process in cases where it is not likely that future Sales Orders will be issued to which the overpayment can be applied to.

To post an advance payment:

- Go to Accounting > Payment receipt

- Enter the “Payment information”

- Enter the Bank, Currency and Amount

- Ensure that the “Amount” entered is the total amount of the payment, i.e. the payment for the outstanding Sales Order(s) plus the amount overpaid

- Enter the Payment reference and Description

- On the “Invoice matching” tab, enter the Customer ID and then click “Search” to load the Open items

- Match the Sales Order(s) to which the payment applies by clicking the check boxes next to the lines and clicking “Match”

- The Open Items will now display in your “Selected items to be matched” section.

- Next, click on the “Advance payment” tab

- Click a blank line under the “Advance payment” section

- The Customer ID, Account, Currency, and “Allocate” amount will auto-populate

- Check that the “Allocate” amount matches the amount overpaid

- Click the check box next to the line and then click “Match”

- The Advance payment line will now display in your “Selected items to be matched” section, along with the lines selected (in Step B. ii) above.

- Ensure that the total payment applied to the Sales Order(s) plus the advance payment is equal to the total payment entered in the “Payment information” section. The “Remaining amount” should now be $0.

- Click Save.

- Enter the “Payment information”

Clearing the Advance Payment

The advance payment will appear as a credit on the Customer Account (the accounting entry when posting the advance payment is DR (debit) Bank and CR (credit) AR). There are several options to clear the credit balance resulting from the advance payment.

- Refund the credit balance to the customer

- Please note that a $38.00 processing fee will apply for wire transfers.

- AR will not refund balances less than $50.00.

- To initiate a refund complete a Refund Request form, located on the Finance Forms page.

- Apply the credit balance to future Sales Orders due

- The customer can short pay their next Sales Order by the credit balance (inform them of the amount)

- When processing the next payment, the credit amount will appear as an Open Item when the Open items are loaded (see Step B. ii). You can then select and match the credit amount.

- Clear the credit balance to income

- The accounting entry to clear the credit balance to income is DR (debit) AR and CR (credit) Income

- Create a Sales Order under the Customer ID in the amount of the credit balance

- Once the Sales Oder has been processed, email acctsrec@viu.ca indicating the Sales Order # and the Credit Note # that should be matched together.

- The matching process can only be performed by Finance

- The matching process must be performed to clear off these two items from the Customer’s Open Items listing

- In FIS (desktop) go to Financials > Accounts Receivable > Transfer to historical items > Manual matching open items

- Check off the Sales Order and Credit Note and click Save

- Confirm that these have now been moved to Historical Items in “Maintenance of open items

- In FIS > Accounting > Accounts Receivable > Maintenance of open items

The following video outlines how to complete and upload Treasury Excelerator files to record revenues from external systems (i.e. Ancillary).

G8. Listing of Treasury Excelerator files

G7. Treasury Excelerator uploads

How to perform Excelerator uploads: generic - video

How to perform Excelerator uploads: generic - video transcript.txt

International Education revenue, AR, and cash handling processes

The following process document and videos outline the new implementation requirements for processing international group contracts.

K1. International Group Contracts Process

Processing a 3rd party contract with SLED implications part 1: contract filing and SLED manual payments - video

Processing a 3rd party contract with SLED implications part 2: Sales Order creation - video

Adjusting a Sales Order 1 with SLED implications: Sales Order has not been posted to the GL - video

Adjusting a Sales Order 2 with SLED implications: Sales Order has been posted to the GL - adjusting down - video

Adjusting a Sales Order 2 with SLED implications: Sales Order has been posted to the GL - adjusting up - video

Adjusting a Sales Order 2 with SLED implications: Sales Order has been posted to the GL - reversals - video

The following process document and videos outline the new implementation requirements for processing international development contracts.

K2. International development and contracts processes

The following process document and videos outline the new implementation requirements for processing all homestay arrangements.

Creating a new customer (students) and creating a new vendor (host families) - video

Creating a new customer (students) and creating a new vendor (host families) - video transcript.txt

Homestay SLED transactions - video

Homestay SLED transactions video transcript.txt

Processing a Homestay Sales Order - video

Processing a Homestay Sales Order - video transcript.txt

Managing Homestay family deposits - video

The following process document and videos outline the new implementation requirements for the processing of all Guardme payments collected from students.

International ad hoc invoicing relates to situations where an Invoice/Sales Order is required, but transaction does not have anything to do with SLED or students. These situations are considered to be identical to regular Trade Sales Orders. See training section above titled "How so I create and process - regular Trade Sales Order (not a contract or sponsorship)?"

Operational requirements will sometimes involve accepting miscellaneous, non-student-related payments, such as recovering immigration costs from visiting scholars. In this case, the process is the same between domestic and international. Please refer to the above domestic process "How do I complete my - cash sales on campus?" to determine the steps required to facilitate this.

The process for issuing invoices with deposits is the same between domestic and international. Please refer to the above domestic process "How do I create and process - Sales Orders with deposits?" to determine the steps required to facilitate this.

The processes for external sponsorships and internal scholarships and bursaries (cost centre payments) are the same between domestic and international. Please refer to the above domestic processes "How do I create and process - external sponsorships" and "How do I create and process - domestic internal scholarship and bursaries (cost centre payments)?" to determine the steps required to facilitate this.

Upon deployment, all International Field Schools must be created as regular courses within SRS.

The process and rules for payment acceptance are now standardized in FIS. In other words, there are no differences between international and domestic. Having said this, there are some specific payment types that international receives (such as wire payments) that have specific requirements. For a complete overview of the requirements related to applying payments, see "How do I accept payments against Sales Orders?" above under Treasury and Finance specific processes.

Please see the decision guide at the top of this page under the heading:

Decision guide for grants, contracts, scholarships and bursaries (with T4A implications)

No. You must add all necessary documentation when you create the Sales Order. If you do not, your Sales Order will be rejected. Sales Orders are reviewed by AR Treasury on a first in first out basis, which means that your Sales Order will return to the back of the queue if it is rejected due to incompleteness.

General Ledger corrections (non-payroll)

If a business unit, area or department identifies a transactional error, the means to having this corrected will be to populate the Journal Entry Voucher Request Form to be obtained from the Financial Services forms website.

Requests for corrections will be considered on a case by case basis by the finance area responsible for posting the originating transaction.

Requests for corrections will be considered only if the dollar amount of the correction exceeds the following thresholds:

To submit a request for a correction:

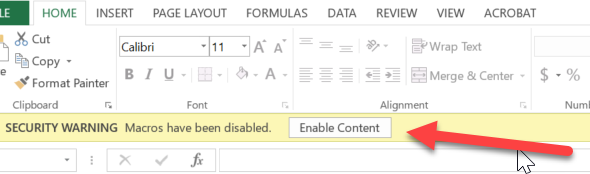

- Complete the Journal Entry Voucher Form. Instructions on completing the form can be found in the “Instructions” tab of the form.

The Finance Forms website contains the current Journal Entry Voucher Form

After opening the downloaded form, click the "Enable Content" button to allow full functionality:

- Send the completed form in Excel format to the appropriate approver(s) via email.

- Have the appropriate approver(s) provide their authorization via email. Approvers should email their approval direct to generalaccounting@viu.ca with the Excel form attached.

- The appropriate finance area will review the request and post the correction if the threshold criteria is met.

Zoom session recordings for sales training

Finance sales training launch session Jun 8, 2021 - video

Finance sales training launch session Jun 8, 2021 - video transcript.txt

Slides from the presentation. Tips and answers to questions start on slide 11: Sales Q and A presentation Jun 17, 2021.pptx

Sales training Q&A session #1 - Jun 17, 2021 (video)

Sales training Q&A session #1 - Jun 17, 2021 - video transcript.txt

Slides from the presentation. reminders and answers to questions start on slide 21:

Sales Q & A presentation Jul 21, 2021 slides

Sales training Q&A session #2 - Jul 21, 2021 (video)

Sales training Q&A session #2 - Jul 21, 2021 - video transcript.txt

Support Materials

Read first - finance training guide part 2: Sales

Choose your own training adventure guide for sales chart

Materials list for sales training This list was created in Jun 2021 so it may not have all of the current items on it. Use it as a guide only.